ESG Sentiment Analysis

ESG sentiment analysis is a powerful tool for managing environmental, social, and governance (ESG) risks for investors, GPs, and portfolio companies.

Investment managers and portfolio companies face increasing pressure from governments, employees, and consumers to follow guidelines intended to make them socially responsible. If the trend continues, it will become as essential to measure a company or portfolio’s performance concerning ESG issues as it is to measure financial performance.

Moreover, there is a widespread sense that ESG performance will significantly affect financial performance – due to popular movements, government intervention, or a combination of both.

The Challenges of Measuring ESG Performance

Measuring ESG performance is more complex than measuring financial performance, and this makes sense. Financial and accounting metrics developed over more than a thousand years, while ESG measurement has had barely more than a decade to develop, at least in its current form.

Problems with the current standards of ESG performance include their reliance on survey data and public disclosures by management rather than objective sources, a bias towards focusing on factors that are easiest to measure, and a focus on granular KPIs rather than holistic outcomes. Achieving sustainability or diversity goals KPIs does not always translate to a reduced carbon footprint or a more inclusive corporate culture.

How Window Measures ESG Risk with Sentiment Analysis

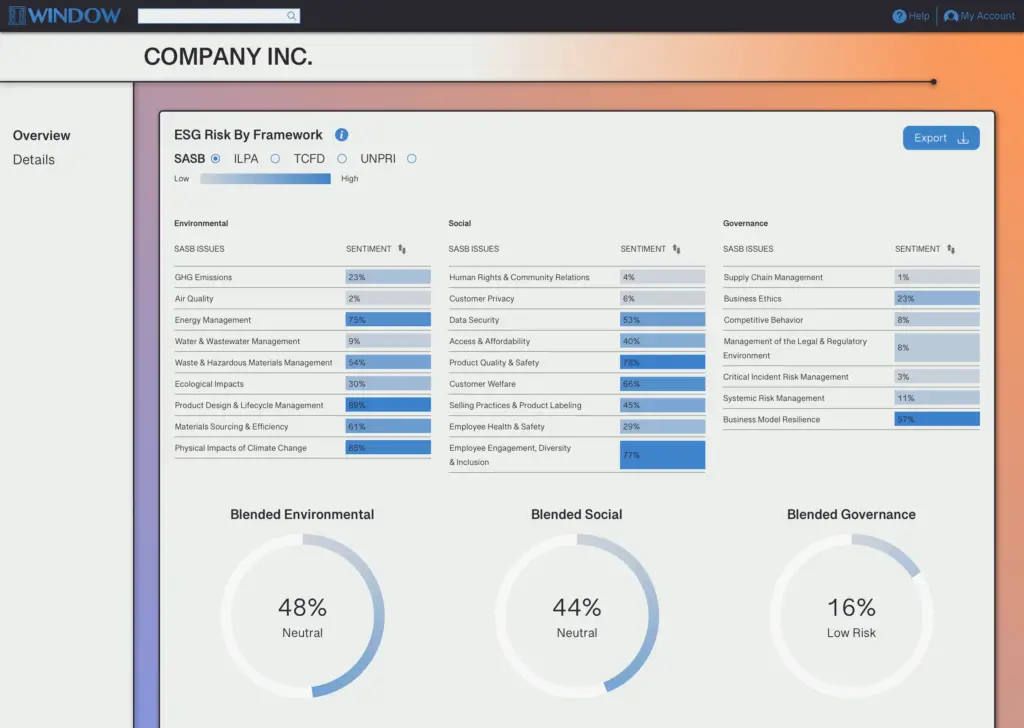

Window’s sentiment analysis software applies proprietary natural language processing algorithms to assess how content created by third parties – not company management – is disposed to its subject matter.

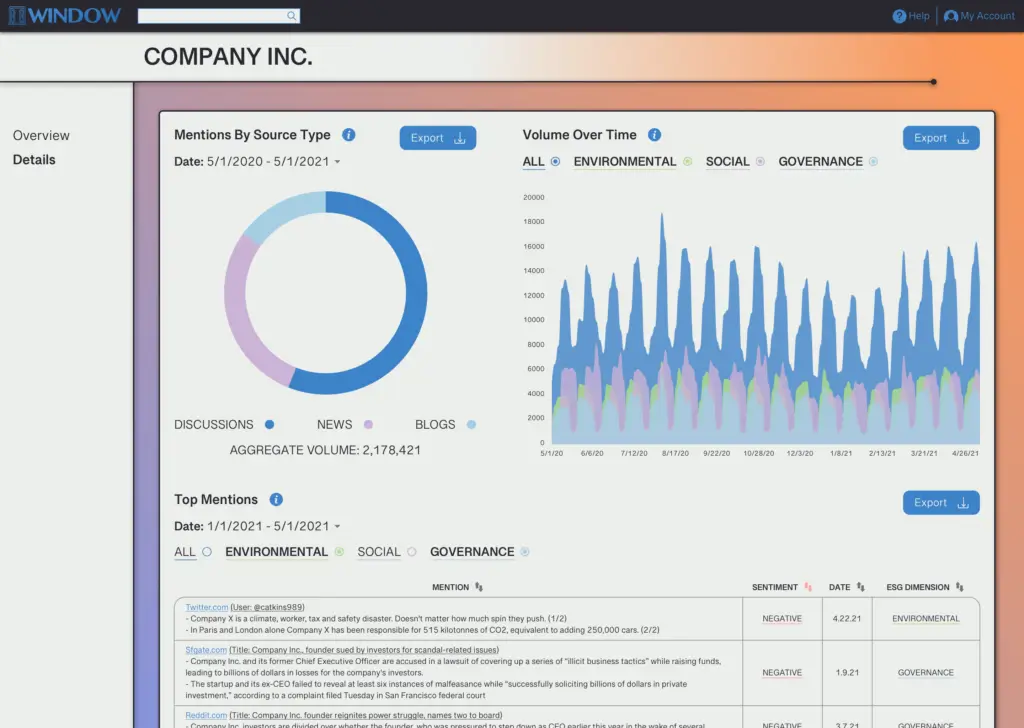

Window incorporates millions of sources of textual data across the internet to understand how stakeholders perceive a business. These data sources include news articles, social media posts and comments, online reviews, employee reviews and discussion, statements by government agencies and politicians, and more.

These textual data sources are then evaluated in terms of sentiment and emotion. Window then filters these mentions by sentiment, topic, industry, and company and rolls these companies up into portfolios.

By using sentiment analysis to measure ESG performance, Window is able to evaluate companies based on their actions, rather than their public disclosures. This has several advantages for stakeholders across the capital stack:

- It gives investment managers and creditors insight into how the public and their governmental representatives perceive a portfolio company or potential investment, without relying on anecdote or needing to wait until a scandal erupts.

- It allows company management to evaluate its ESG risk management strategy in both its operations and public relations.

- It allows investment managers and limited partners to benchmark entire funds based on public discourse surrounding their investments.

- Purchasing departments can manage ESG risk in their supply chain by evaluating discourse surrounding vendors, rather than relying on conversations or disclosures.

How Window Can Help

Since natural language processing is a form of machine learning, Window’s NLP algorithms are constantly improving their ability to evaluate textual data.

Window continually updates its internal libraries of related phrases and semantic dictionaries. This process accelerates as our algorithms consume more data, improving their accuracy and precision.

This technology enables Window to evaluate textual data better than any human analyst applying a rules-based system – not just because of the breadth of data it can consume, but also because of its consistency.

The future of ESG reporting will rely heavily on sentiment analysis, for managers as well as capital allocators, because it is the most effective real-time snapshot that does not rely on a comprehensive audit. ESG is a domain of shifting ideas and standards, where the demands of regulators, purchasing departments, investors, and the public will be diverse and ever-changing. Sentiment analysis offers a level of speed and flexibility that will ensure it largely displaces primary research for ESG reporting.

The Future of Sentiment Analysis and ESG

As the demand for ESG metrics develops, investors and regulators will become increasingly dissatisfied with primary research that relies on survey data and public disclosures. This is both because this research relies on subjective statements, incorporates too narrow a range of data, and because the lag time is too long.

In the private markets, too much of what passes for ESG investing basically relies on the company’s industry sector. Energy companies get worse ratings than retailers. However, this is quite trivial. Of course, from an overall perspective, funds with oil and gas investments present greater ESG risk than funds that invest purely in EdTech. However, they also offer greater potential for positive environmental impact through innovation.

Therefore, the ESG research and ratings industry must develop standards in the private markets that reflect differences between industries. This is critical for ESG investing to help build a responsible future rather than devolve into virtue-signaling.