About Window

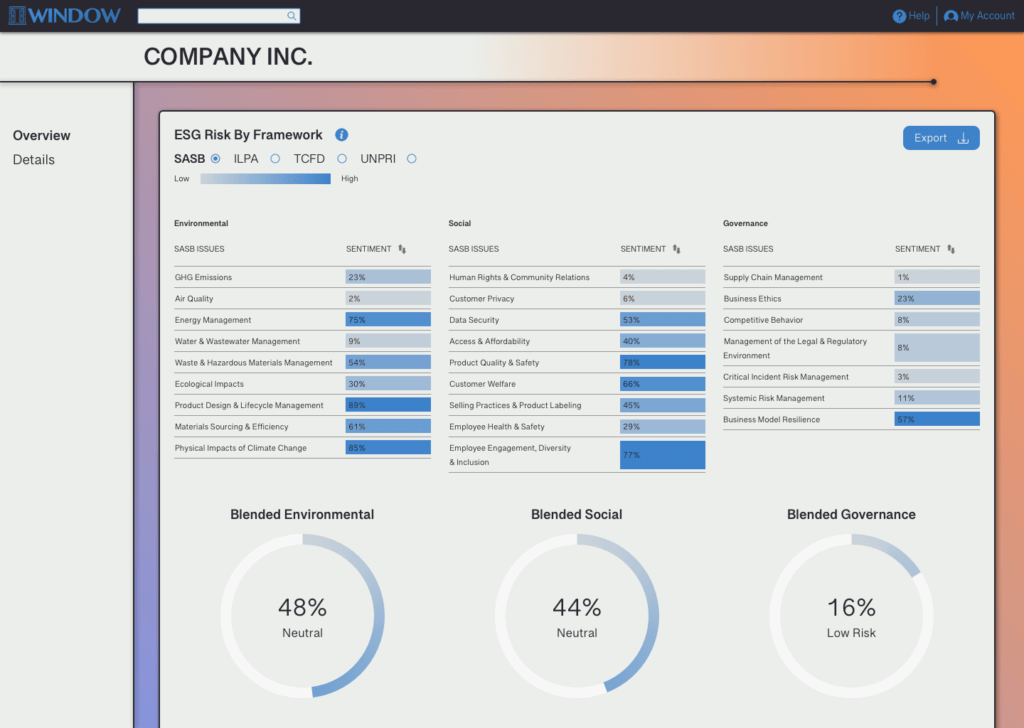

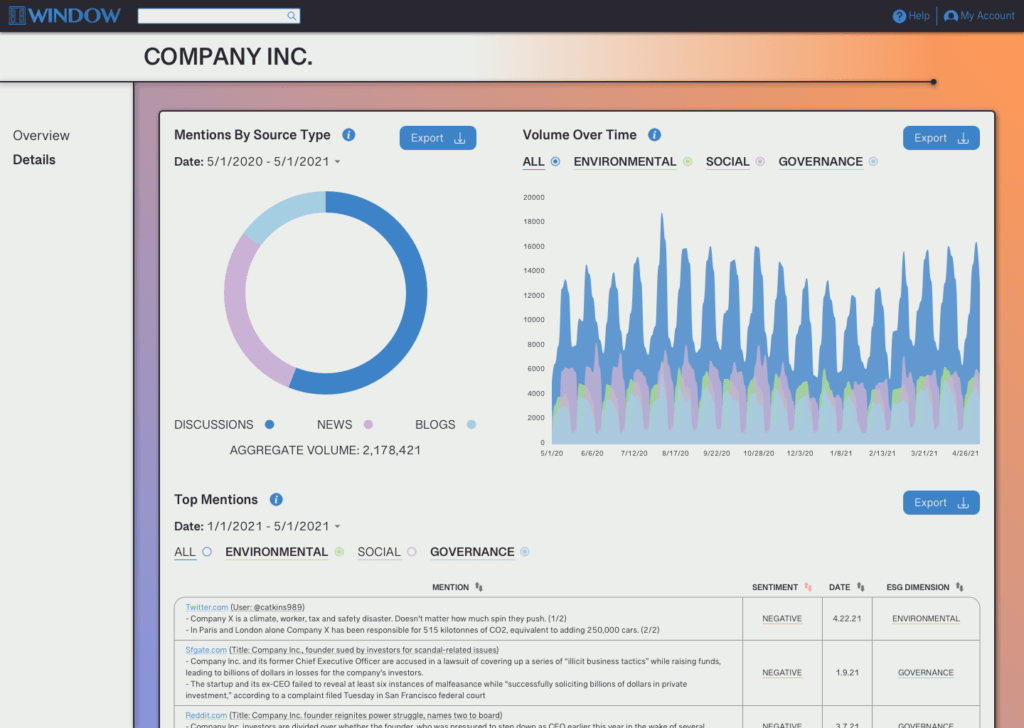

Window is the leading ESG risk assessment tool for fund managers and investors who wish to monitor their portfolio for ESG risk and report on that risk to their allocators. Instead of relying on what companies say, Window focuses on what companies actually do.

Others in this space focus on public markets only, on broader investment-research use cases, or seek to measure risk based on available disclosures or simply industry sectors (oil and gas is riskier than software, etc.).

Disclosures often occur only after risks have led to incidents, and private companies’ disclosure requirements are insufficient to foster trust.

Meanwhile, measuring ESG risk based on industry sector is too broad and does not reflect that different companies in the same industry might manage ESG risk in different ways, with wide variance in effectiveness.

Window Is For:

- Private Equity Fund Managers

- Hedge Funds

- Institutional Investors

- Investment Research Professionals, ESG Analysts, and Third-Party Marketers

- Portfolio Companies

- Purchasing Departments and Supply Chain Specialists