ESG Ratings Software

ESG ratings software from Window allows organizations and investors to manage their ESG performance in real-time.

While traditional sustainability reporting relies on the opinions of primary researchers and corporate disclosures, Window’s ESG ratings software is the first product that provides ESG ratings based on what companies actually do – not just what they say.

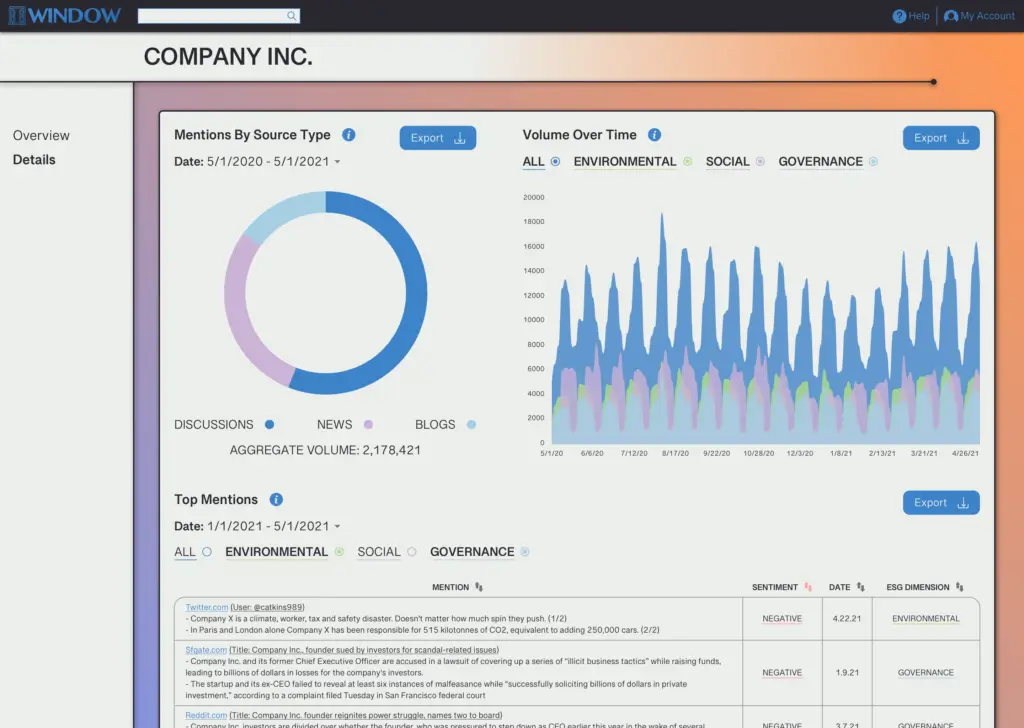

Window’s natural language processing (NLP) algorithms incorporate millions of textual data points across the internet, including social media posts, news articles, blog comments, online reviews, and of course, corporate press releases, annual reports, and disclosures.

Unlike primary research firms that provide ESG ratings every quarter, Window provides ESG ratings in real-time. This continuous reporting rhythm empowers corporate managers to respond to ESG crises before they become scandals and helps investment managers respond before ESG issues move markets and affect their portfolio’s performance.

Expanding Intelligent ESG Ratings to All Industry Sectors

Many primary research firms base their ESG ratings on industry sector and public disclosures. Such rating systems are better than having no ESG intelligence at all, but present several problems.

First, to function, any system that relies on management surveys or public filings requires that the rating systems trust statements by management – a dicey proposition in an area where there is much room for qualitative judgment and, therefore, spin.

Second, the emphasis on industry sector biases these rating systems against companies in industries perceived to have high ESG risk.

For example, most systems rate oil companies poorly relative to other industries because of perceived environmental risk. However, companies that enjoy much better ratings rely on hydrocarbon-based energy to move goods through their supply chains.

As all companies – including natural resources companies – are being held accountable for ESG performance, as are all investment managers – including oil and gas hedge funds – it is no longer practical to manage ESG risk by avoiding entire industries.

While industries like the energy sector involve greater ESG risk, innovation in these industries may result in a substantial positive impact. Window allows users to keep the big picture in mind when evaluating ESG risk, instead of discriminating against certain sectors wholesale.

Ratings at the Company, Fund, or Portfolio Level

Window enables users to quickly rate themselves, their supply chains, their portfolio companies, an entire fund, or even funds of funds.

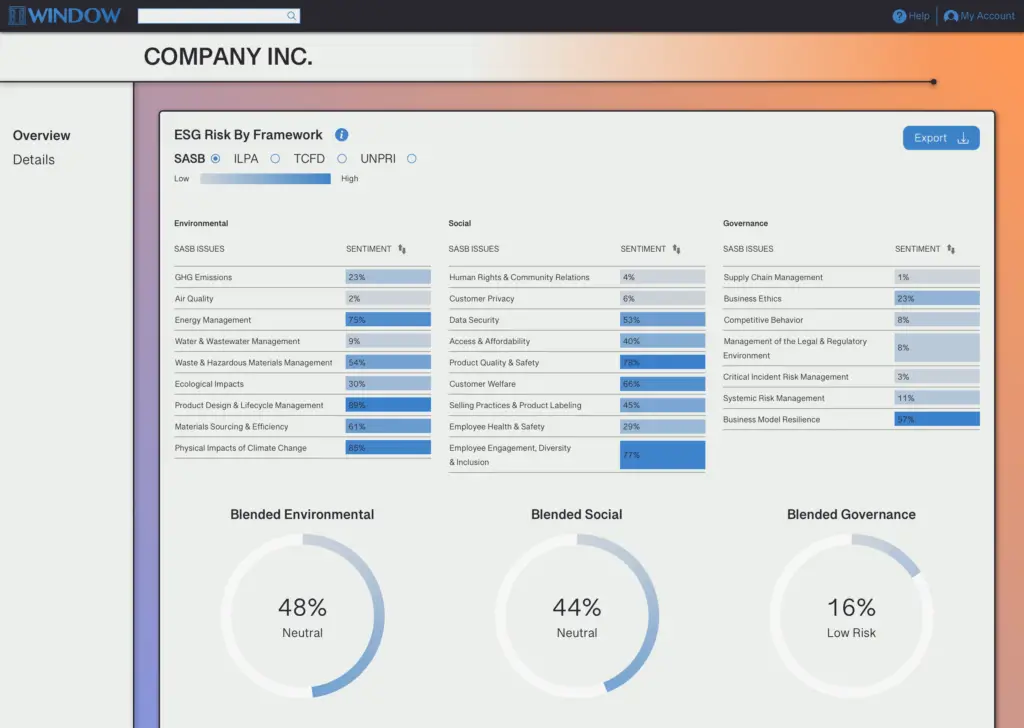

Window’s ESG scores measure ESG performance and risk, based on verifiable textual data.

This data rolls up into environmental, social, and governance scores, and then a final ESG score that incorporates the company’s overall ESG performance based on discourse across the internet.

Window’s Rating Methodology

Window uses a percentage-based scoring methodology across the most commonly-used ESG categories. Window’s data lake draws on textual data sources across the internet, including news articles, social media, forums, and blogs.

Window then uses proprietary natural language processing (NLP) algorithms to create ratings of this data. Window’s data lake incorporates textual sources far beyond the scope of what any human analyst could cover. This breadth allows Window’s scores to place far more emphasis on public discourse than primary research firms, which, in the interest of time, are often forced to rely on the representations of company management.

By emphasizing third-party sources as much as statements by company representatives, Window rates companies based on what they actually do, rather than what they say.

Rate Funds, Funds of Funds, or Individual Companies

Window’s ESG ratings software allows users to access ratings at the company, fund, or fund of fund level. Rolling up ESG risk to the fund level enables institutional investors to quickly analyze their investments to ensure they adhere to ESG requirements.

In turn, investors and regulators increasingly require fund managers to prove that they are fulfilling their ESG mandates. Window provides fund managers – including those invested in private companies, which are not in the habit of reporting ESG information in public filings – with the tools they need to show they’re following through on their mandates.