ESG Investment Analysis Software

Window’s ESG investment analysis software ensures investments in funds and portfolio companies meet required ESG criteria.

Both LPs and fund managers must increasingly incorporate environmental, social, and governance (ESG) factors into their investment and portfolio management decisions.

However, many challenges remain in terms of how to collect and analyze ESG data. Window empowers users to analyze ESG risk at both the fund and company level to make the best investment decisions and report on those factors to stakeholders.

Access the Most Up-to-Date ESG Data

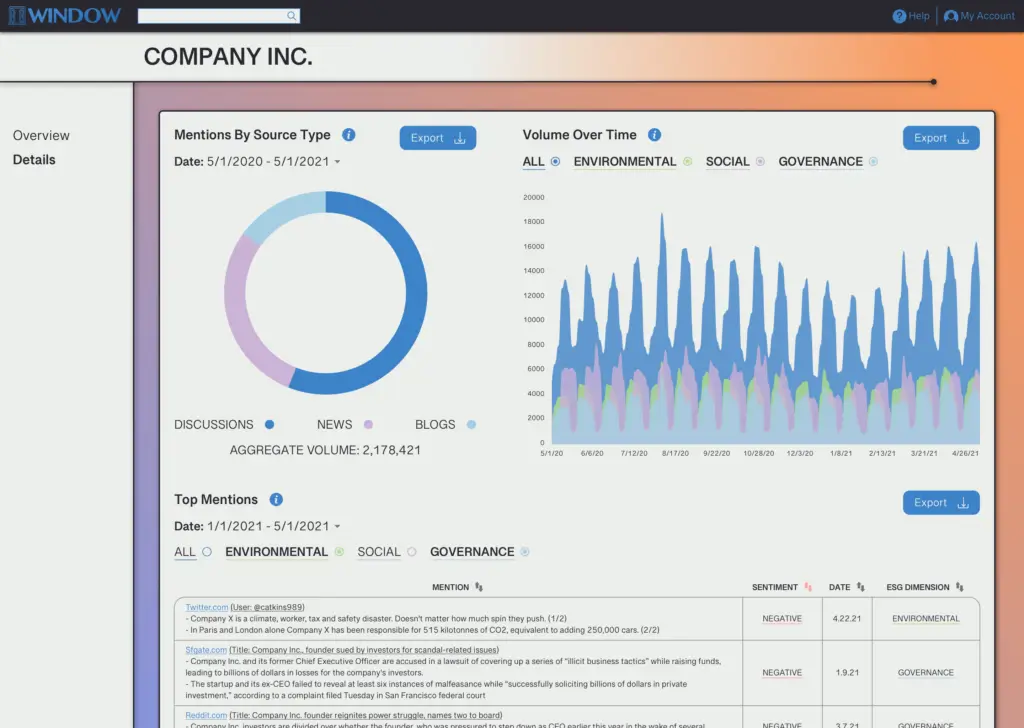

Window’s data sources include national, regional, and local news sites, blogs and forums, product review sites, corporate press releases and annual reports, investment publications, and social media posts.

Our dashboards and data feed are powered by a broad data lake across companies, brands, products, and sectors and provide you with customizable insights and a data display.

Get Ahead of ESG Risk

By extracting data from forums, news articles, blogs, and social media, Window helps investment managers learn about ESG-related crises before they move financial markets.

Window’s coverage includes employee welfare and safety issues, supply chain management, customer privacy, community relations, business ethics, and ecological risk.

Window then connects this data to potential investment risk by leveraging proprietary natural language processing (NLP) algorithms to analyze this textual data. Our analysis considers not just crude indicators like volume, but also the credibility of commentators, sentiment, and emotions.

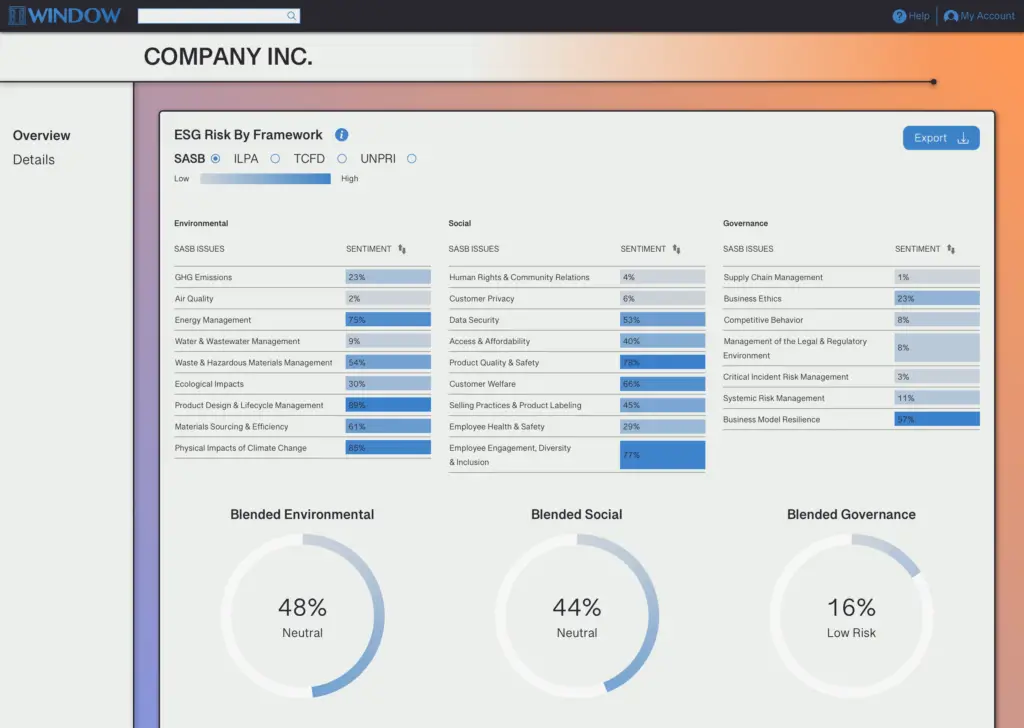

Create Standard and Bespoke ESG Scores

Window turns this text-based data into ESG scores, allowing you to track trends and public sentiment for companies of interest to you.

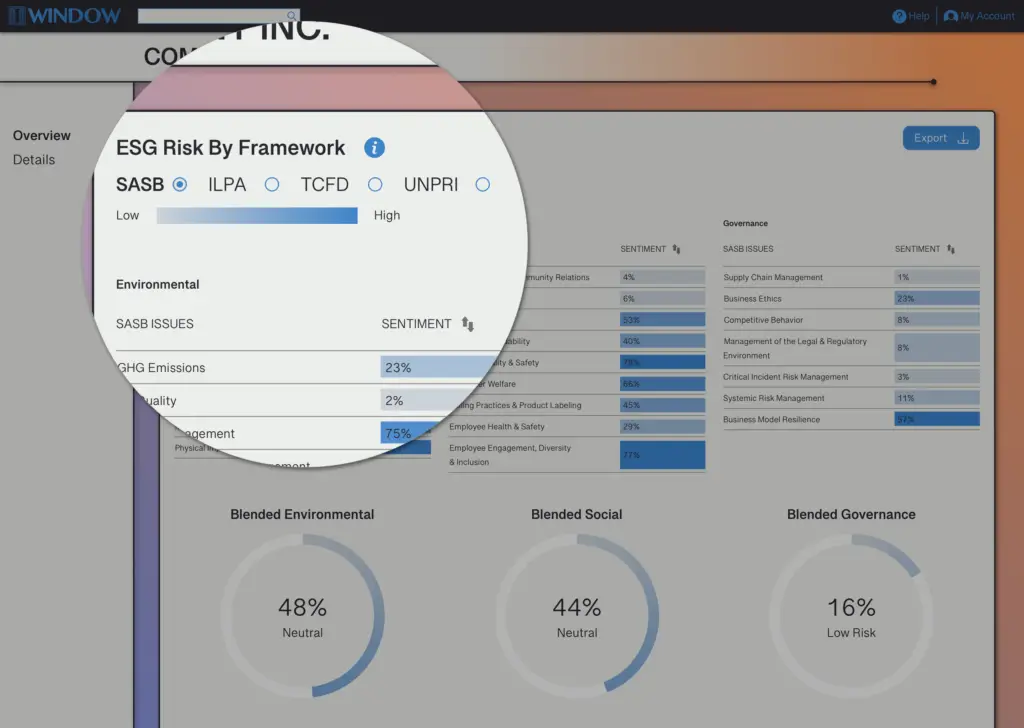

Users can score companies based on the established ESG frameworks, such as SASB, ILPA, or UNPRI. Alternatively, users can build their own bespoke ESG scoring framework for their internal use.

With Window, investors and managers can create alternative data with our sentiment analysis tools and customizable dashboards.

Measure Risk in Real-Time

Get analytics on companies or portfolios on demand and receive up-to-date insight on companies small to large.

Portfolio managers in both the public and private markets can track their portfolios and identify opportunities for value creation or threats of value destruction.

Measure Risk at the Company Level or Roll Up to Evaluate Funds

Users can analyze ESG risks and opportunities at the company level or roll these metrics up to an overall portfolio.

Since Window’s ESG data is based on a company’s actions rather than corporate disclosures, investors at the asset level can use our data to validate whether management claims reflect reality or are just corporate spin.

At the portfolio level, investment managers use Window to analyze their funds, benchmark their ESG risk against competitors, or improve their pitch to limited partners concerned about ESG risk.

At the investor level, Window helps limited partners evaluate whether fund investments align with their ESG goals – before investing and then during the life of the fund.