Corporate Governance Scoring

Window’s corporate governance scoring software allows company management, investors, consumers, and other stakeholders to identify and manage corporate governance risk.

Since the passage of the Sarbanes-Oxley act, investors, media, and the public are paying more attention to corporate governance. Activist investors, and even institutions, show an increased interest in corporate governance issues and exert increasing pressure on portfolio companies to follow best practices and provide greater transparency.

Corporate governance ratings are now a common feature of analyst reports, and the media often pays attention to poor ratings, resulting in unwanted negative press. In addition, there is empirical evidence that better corporate governance increases shareholder value, and perceptions of poor governance can make publicly-traded companies targets for activist campaigns.

Data Collection Process

While many investment research firms provide corporate governance ratings, these traditional data providers largely focus on public disclosures, board structure, audit problems, bylaw provisions, insider stock ownership, and director and executive compensation.

Though these scores are helpful, there is still a considerable lag between incidents and their incorporation into these scores.

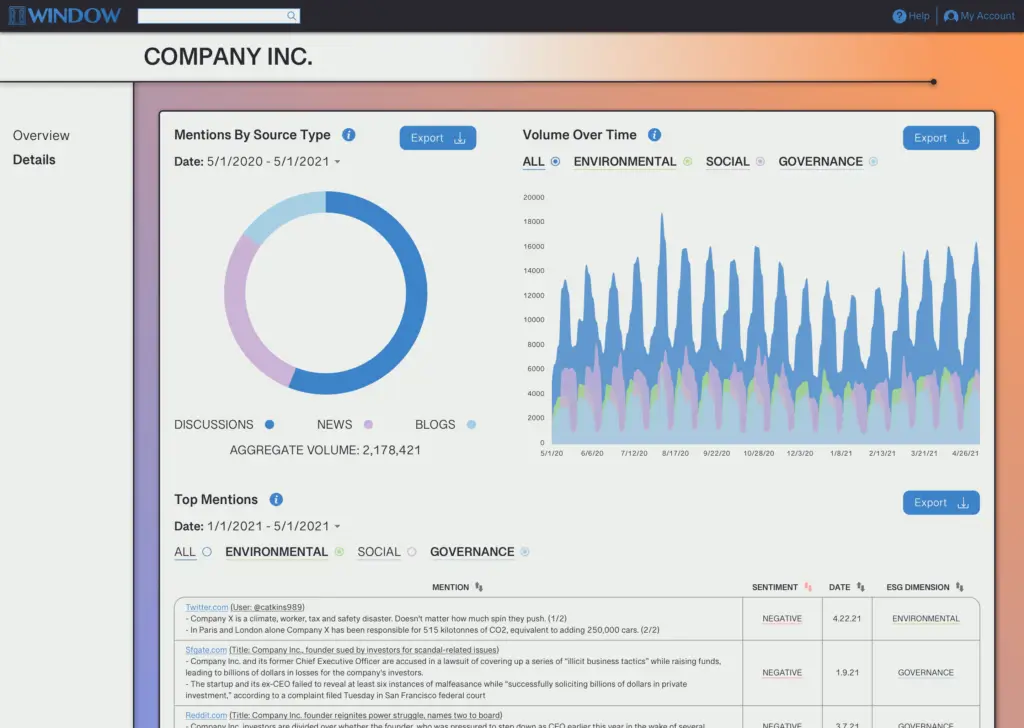

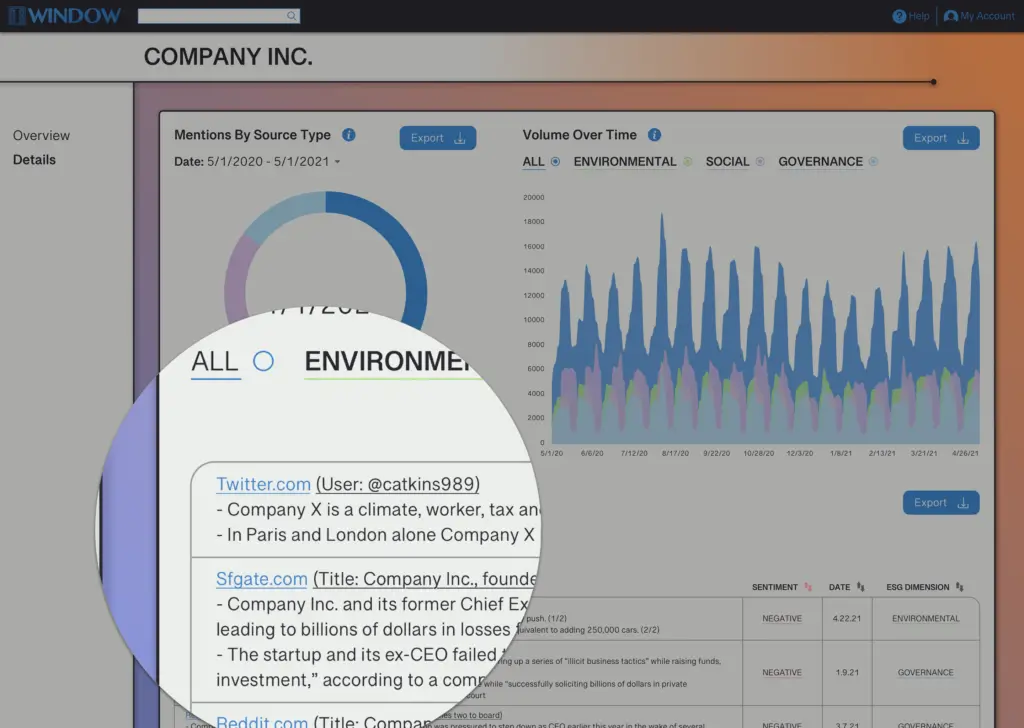

Window’s real-time corporate governance scoring draws on textual data points to reflect incidents and risks as they happen – not months later. Since Window collects data from across forums, social media, news articles, and blogs, corporate governance scores are based on what actually happens in real-time, not corporate disclosures and statements that are often more spin than substance.

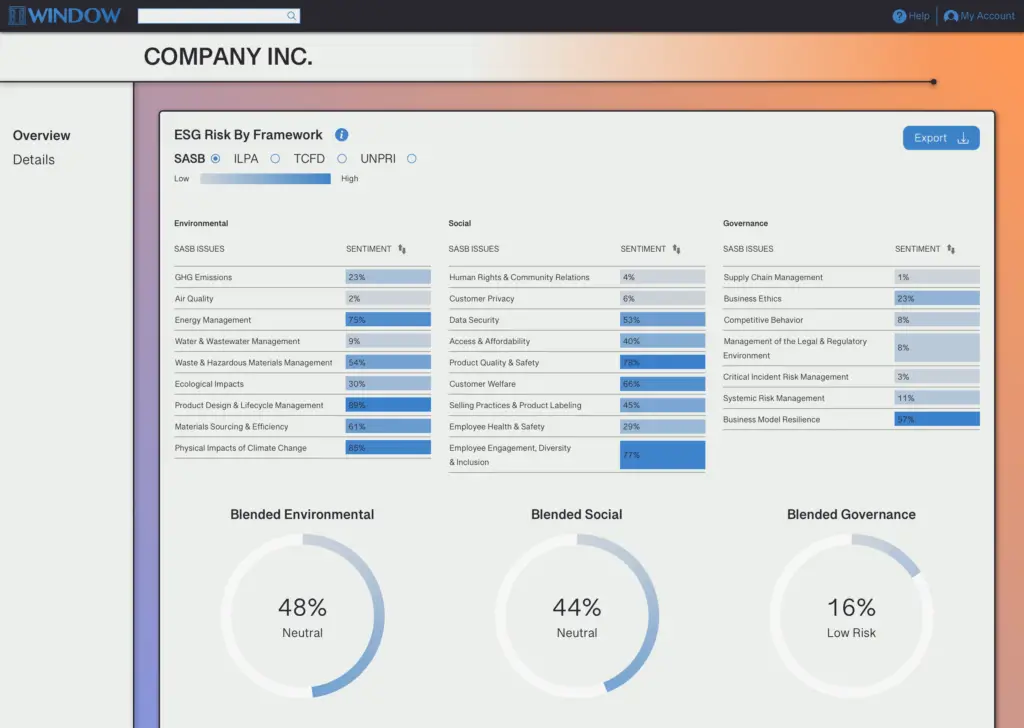

Proprietary Data Analysis Algorithms

Window analyzes its textual data points using natural language processing (NLP) algorithms to detect corporate governance risks – before they affect stock prices or valuations. Window’s NLP algorithms do not just track company mentions relevant to corporate governance and sentiment, but also incorporate the credibility and influence of the commentator, the degree of engagement with the piece, its circulation, and level of emotion – down to the sentence level.

Corporate governance scandals often simmer in public discourse for days, weeks, or months before they become public and affect a company’s prospects. By tracking textual data points across the internet, Window allows investors and other stakeholders to manage corporate governance risk effectively and make appropriate decisions.

Corporate Governance Use Case - Investment Management

Professional investment managers typically use Window’s corporate governance scoring to track the governance risk embedded in their portfolios. Meanwhile, limited partners leverage the same technology to benchmark corporate governance risk across funds they are evaluating.

Window’s corporate governance scores also allow fund managers to make credible representations about their management of corporate governance risk in presentations to current and prospective limited partners.

Corporate Governance Use Case - Management, PR, and IR

In addition to the investment use case, Window’s corporate governance scoring is helpful to company management teams that want to survey public perception in an increasingly stakeholder-centric environment.

Corporate governance scores allow management to get ahead of potential scandals and plan responses before stories break from social media into the mainstream press. This intelligence enables management to control the narrative by planning answers to possible questions from shareholders, the public, or regulators.

Public relations teams and investor relations departments use Window not just for crisis and reputation management, but also for media monitoring.

Corporate Governance Use Case - Boards of Directors

Window’s corporate governance scores are also helpful for boards of directors who wish to manage risks associated with actual or perceived corporate governance issues. For directors, it is essential to get ahead of corporate governance issues before traditional primary research incorporates these problems in the most widely-used rating systems.

Early action is critical because a drop in governance ratings, without a proportionate response, may affect the director’s representation in the business community and the public more generally, interfering with future opportunities.